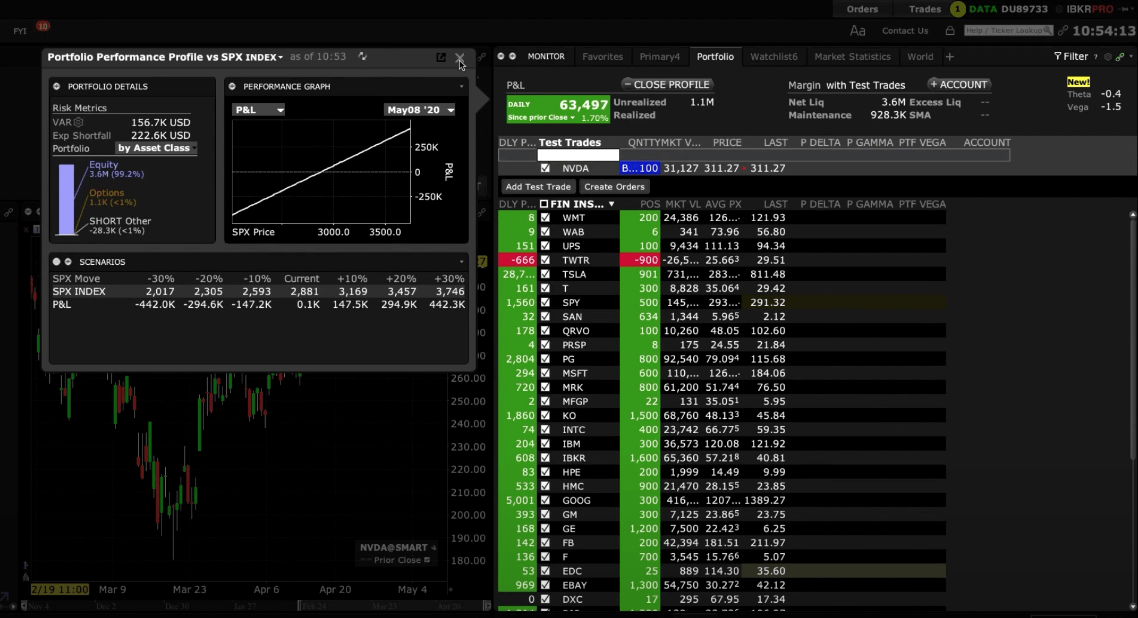

Cfd trading account

I also discovered that FXTM offers below-average trading fees. The combination of raw spreads (from 0.0 pips) and a $5 round-turn commission per traded lot (100,000 units) on the Advantage account is geared toward the needs of high-frequency traders Versus Trade. Those may include day traders and scalpers.

Spreadex is a UK-based and FCA-regulated broker offering CFD trading and spread betting. It also offers sports betting and is regulated by the UK Gambling Commission. Spreadex offers thousands of tradable instruments, competitive spreads in popular assets, and an innovative proprietary platform.

We determined RoboForex as an excellent choice for algorithmic traders, thanks to its comprehensive offerings. They can choose between MetaTrader 4 and MetaTrader 5 platforms, both of which feature Expert Advisors (EAs) and include built-in strategy testers, allowing algorithmic traders to backtest their strategies against historical price data.

I executed several trades on the FXTM mobile app, which has an easy feel to it. The app’s intuitive design makes it extremely easy to navigate, and even newbies can quickly make their way around it. The greatest advantage of the app is that it eases order execution. Traders can get in and out of positions in several seconds, which could prove crucial in times of heightened market volatility.

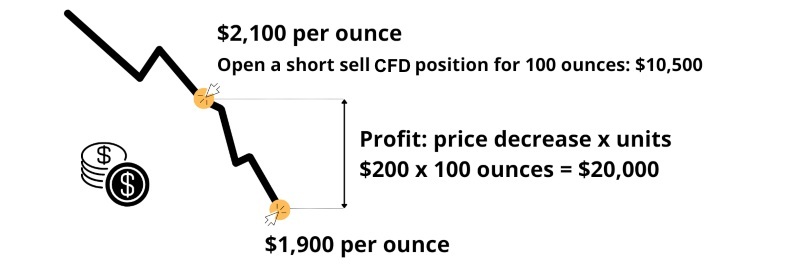

Cfd trading example

CFDs trade over-the-counter (OTC) through a network of brokers that organize the market demand and supply for CFDs and make prices accordingly. They’re not traded on major exchanges such as the New York Stock Exchange (NYSE). The CFD is a tradable contract between a client and their broker. They’re exchanging the difference in the initial price of the trade and its value when the trade is unwound or reversed.

Disclosure: This article is not intended to provide investment advice. Investing in securities entails varying degrees of risk and can result in partial or total loss of principal. The trading strategies discussed in this article are complex and should not be undertaken by novice investors. Readers seeking to engage in such trading strategies should seek out extensive education on the topic.

In this example, your position margin will be $10,004 (20% x (1,000 (units) x $50.02 (buy price)). Remember that if the price moves against you, it is possible to lose more than your initial position margin of $10,004.

CFDs trade over-the-counter (OTC) through a network of brokers that organize the market demand and supply for CFDs and make prices accordingly. They’re not traded on major exchanges such as the New York Stock Exchange (NYSE). The CFD is a tradable contract between a client and their broker. They’re exchanging the difference in the initial price of the trade and its value when the trade is unwound or reversed.

Disclosure: This article is not intended to provide investment advice. Investing in securities entails varying degrees of risk and can result in partial or total loss of principal. The trading strategies discussed in this article are complex and should not be undertaken by novice investors. Readers seeking to engage in such trading strategies should seek out extensive education on the topic.

Cfd trading account

No, you can keep your demo account open for as long as you like and you can use it to test strategies, even after you’ve opened a live account. Add more virtual funds at any time via the ‘Payments’ menu.

When purchasing a stock through your broker’s trading platform, your broker holds the shares (or, share certificates) on your behalf. As the shareholder of record, you gain certain rights and privileges – such as voting and taking part in proxy meetings. You also become eligible to receive potential dividends.

Futures, on the other hand, are contracts that require you to trade on the expected future price of a financial instrument. Unlike CFDs, they specify a fixed date and price for this transaction – which can involve taking physical ownership of the underlying asset on this date – and must be purchased via an exchange. The value of a futures contract depends as much on market sentiment about the future price of the asset as current movements in the underlying market.

For example, if a trader buys a CFD on the EUR/USD pair and the contract price moves higher than the initial purchase price, the unrealized profit will be the difference between those two prices (minus any applicable trading costs).